The Importance of Mortgage Pre-Approval Before You House Shop

It's an exciting time, for sure! But before you get caught up in a real estate buying frenzy, make sure you take this critical step first.

We know it's not terribly sexy, but neither is falling in love with a house you can't afford.

Getting pre-approved for a mortgage is an absolute must, if you're really serious about owning your own home.

This necessary step is also a powerful one because it places you in the driver's seat.

How?

Pre-approval skirts any possible obstacles to buying your dream home before you find it. If you have credit issues, you can clean them up.

It also gives you the opportunity to discuss mortgage financing options with your chosen lender, and it makes you more competitive in the real estate marketplace.

Real estate agents don't want to waste their time with house hunters who haven't done their homework.

If there are multiple bids for the same house, your offer will be given little weight because you didn't get pre-approved.

Sellers simply won't waste their time without seeing a pre-approval letter.

That's the power of preparation!

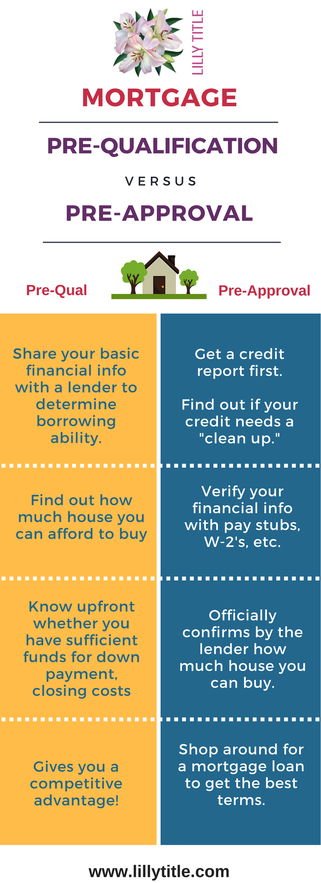

Pre-Qualification vs Pre-Approval

Getting pre-qualified means you have shared your financial information with a lender.

The lender, in turn, provides an informal estimate of your borrowing power.

It isn't a binding agreement, but mortgage pre-approval does carry weight because the buyer does goes through a formal mortgage application process.

That's because a buyer provides financial documents and LOTS of data to the lender. The lender can then determine how much house you can afford to buy.

It also spells out whether you have enough money for a down payment and closing costs.

Generally, you can get pre-approved in 24 hours or less. And the report is valid for 60-90 days.

For pre-approval, we recommend you get a free credit report first. Federal law entitles you to one every 12 months from each of the three national consumer bureaus.

What's Involved with Getting Mortgage Pre-Approval

You don't want surprises!

If there are issues with your credit, this is the time to get them resolved.

Your lender will want to verify certain aspects of your financial situation such as:

--Your employment-You'll need pay stubs

--W-2's

--Federal tax returns

--Social Security payments, if any

--Savings, investment account information, and checking account

--Do you have retirement benefits? VA? Those will need verification

--Driver's license, your Social Security number, passport

Remember, you could get rejected by a mortgage lender through no fault of your own.

Approval consists of more than just your eligibility. Lenders have different levels of risk that they are willing to work with.

It could be something about the property that the lender doesn't like.

If one says "no," go look for another lender. It's a big marketplace. Shop around!

Visit Lilly Title & Settlement's website to learn more getting title insurance for your new home. We also have many other articles related to homebuying.

RSS Feed

RSS Feed